Southeast Asia is a great place to invest. I don’t just mean investing money; I mean investing time, effort, and attention into the region. The economic landscape of Asia and Southeast Asia is rapidly changing; it will look much different ten years from now than it does today. There are many reasons for this, so I’d like to take a look at a few of them that I think are especially important.

EASE OF DOING BUSINESS

Doing business in Southeast Asia has its ups and downs. Depending on which country you decide to do business in, it can range from smooth to frustrating. You will need to learn local customs, but that’s the same as almost anywhere else in the world. However, some countries in Southeast Asia are now the best places in the world to do business.

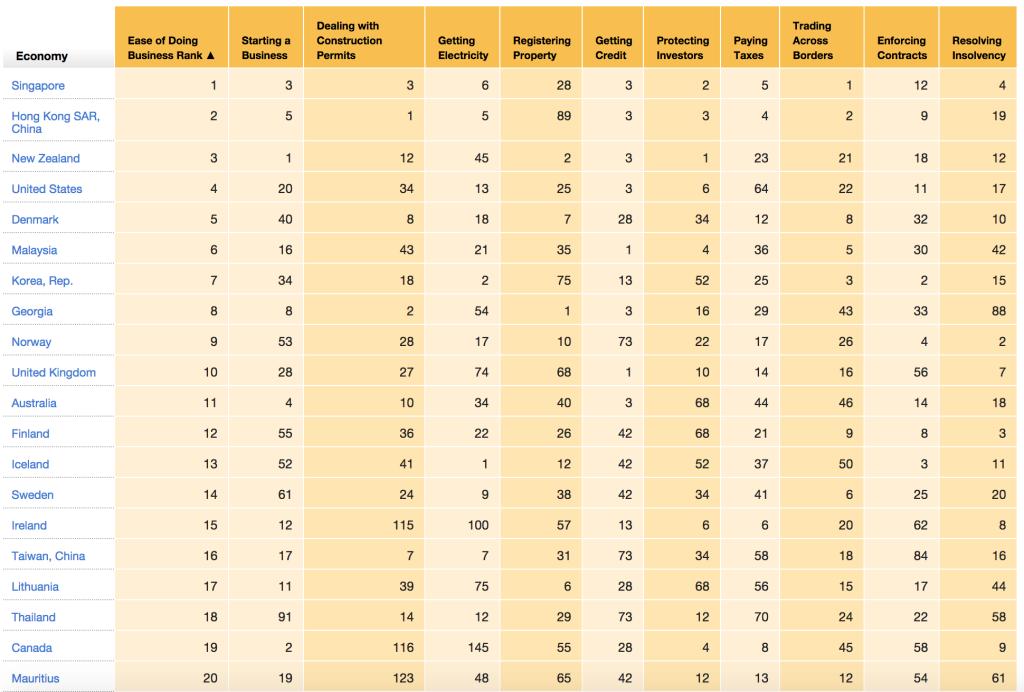

If you look at the data from the World Bank on their ease doing of business rankings for countries you’ll see that Singapore is in top, Hong Kong (technically not in Southeast Asia, but close enough) is second, and Malaysia is sixth, behind Denmark and the US.

STARTUP-FRIENDLY ENVIRONMENTS

In many parts of Southeast Asia, the environment is becoming increasingly friendly for startups. Singapore’s government leads the way with a number of programs designed to help startups grow and succeed, some of them matching third-party investments dollar-for-dollar. Malaysia’s government has its own startup fund, and if you’re creating a software development or e-commerce business in Thailand the Thai government will allow full foreign ownership, lower barriers to employment, and various other perks. Vietnam also recently received $110M USD from the World Bank, of which a rumored $10M will be going to startups.

TREMENDOUS GROWTH OF THE MIDDLE CLASS

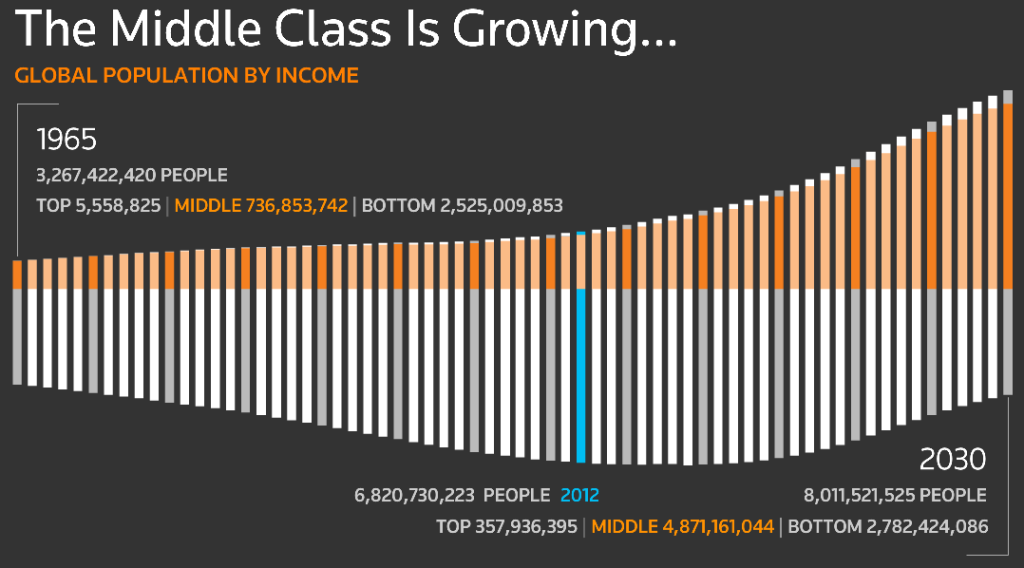

According to data from Reuters, the amount of people in the world who are in the middle class will grow from about 14% today to about 61% in 2030. Almost all of this global middle class growth will be in the entire Asia region, with huge growth in Malaysia, Indonesia, Vietnam, and Thailand. Other countries outside of Southeast Asia that will also see significant growth in their middle classes are China, India, and Brazil.

Fifteen years, from now, the percentage of middle class in the United States and Europe will only be about 22% of the global total. On the other hand, about 64% of the middle class will be in Asia. Overall, the projections show that the region will be a new center of economic activity a few years down the road.

As the economic center of gravity shifts again away from the West, I think it’s wise to hedge bets for the future by investing some time and money into in Southeast Asia. It looks like there exists a tremendous opportunity in the next five to 10 years to capitalize on the growing trends in the region. What are your thoughts? Let us know in the comments below!