During my travels, I’ve always set aside some time to research real estate in local or nearby markets—not necessarily with the intention to buy, but more for my own knowledge. I’ve always been interested in both real estate as well as Asia and its tremendous growth prospects, for which I had written an article previously. My research led me to Cambodia, where the market has heated up for a while already. I dug a little deeper, did a lot of research, and eventually flew Phnom Penh, the capital city, to do boots-on-the-ground research before finally purchasing a condominium unit in the Olympia City mixed-use development project.

Disclaimer: I am not a real estate professional, nor do I claim to be one. This article is merely a collection of some of my research and should not be construed as real estate advice. As always, do your own research, check your facts, and make your own decisions.

Why Cambodia

As I mentioned earlier, the entire Asia region is growing tremendously, and it will account for 64% of the world’s middle class by 2030, up from 22% in 2012. Cambodia has grown rapidly in the past few years, and foreign investment has poured into the country—mostly from other Asian countries such as China, South Korea, Japan, and Taiwan. According to data from the world bank, Cambodia has experienced 7-8% GDP growth in recent years, and the future prospects look bright, with the next few years projected to achieve the same amount of GDP growth.

Cambodia is also somewhat less risky than many other developing countries because, although the official currency is the Riel, literally everyone uses US dollars there. This reduces currency risk, assuming the United States continues to be an economic superpower (looking at current trends, there’s reason to be wary).

Additionally, the price of real estate in Cambodia, for what you get, is still a relative steal compared to many other places in the region. Even though prices have risen for the past few years, your dollar still goes very far in an absolute sense.

Finally, integration of Cambodia into the Association of Southeast Asian Nations (ASEAN) economic community will open up many more opportunities in the country. This is supposed to happen before the end of 2015, however the latest news seems to show that it may not occur until 2016.

Cambodian Laws

Unlike many other countries, Cambodia does not allow foreigners to own land. However, since 2009 foreigners have been able to buy units in their own name above the ground floor of any housing development. This means that residential condominium complexes are fair game. The units in these condo complexes usually have freehold (you own it outright) or 99-year leasehold titles.

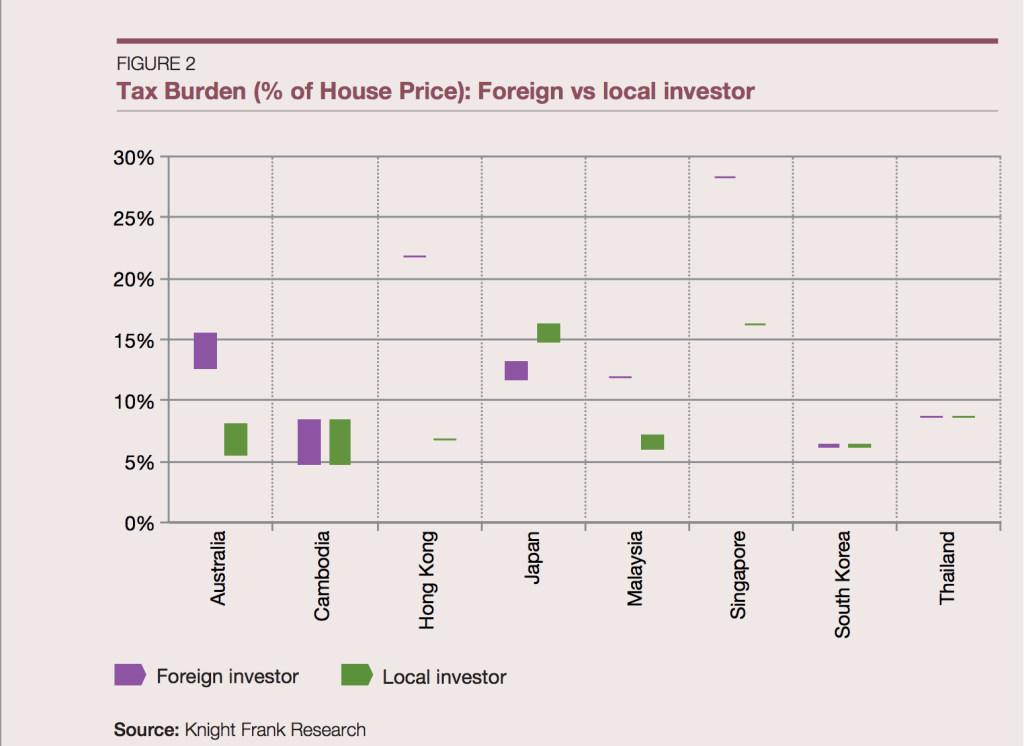

If we look at the above chart showing the tax burden of owning Cambodian property from Knight Frank research, we can see that there are no differences in owning property if you are a local or a foreigner in terms of taxes.

Unlike many other Asian countries (Hong Kong, Malaysia, Singapore), it does not cost more to buy a residential condominium as a foreigner versus if you are a local. In fact, the country makes it relatively easy for foreigners to carry out real estate transactions. For some more detailed information, please check out the Global Property Guide site on Cambodia.

Breakdown of Costs

I purchased a 50.5 square meter (approx. 500sqft) junior 1-bedroom 18th floor inward-facing unit in the Olympia City complex because it is very centrally located in Phnom Penh. Additionally, the purchase terms were extremely attractive, with a 30% down payment required, while the remaining 70% can be purchased in cash or via bank loan. However, the terms of the 30% down payment were exceptional because I only needed to put down $5,000, and get charged $650 per month for the first year, and $800 per month for the second year, interest-free (!!) until the completion of the project in mid-2016, at which point I’d have to hand over the rest of the 30% down payment and secure the loan or pay the rest in cash. The unit is in C3, the front center building, in the photo below:

This payment schedule was much, much more attractive than other complexes (such as all the projects being built on Diamond Island, like DI-Riviera) which required either the full amount paid or loaned at least a year before the project was completed.

The condo unit comes unfurnished with two exceptions: the bathroom is fully furnished, and the kitchen includes all appliances sans refrigerator.

The expected rental yield by the time the unit is completed is around 8-10% on the low end. However, because of extremely high interest rates (10%), the rent may not cover the mortgage, obviously depending on how much I can eventually rent the unit out for. I’m currently still trying to find a property manager that I can trust, so if anyone has any suggestions please do let me know.

Monthly maintenance fees for the units in the complex are still unknown but are expected to range from $0.50 to $0.80 per square meter, which would come out to $25.25 to $40.40 per month—a steal compared to other parts of the world for the amenities that you will be getting (gym, multiple pools, 24hr security, doormen). Yearly property tax is supposed to be less than $200, but we’ll see about that.

Rental income tax is fixed at 10%, and capital gains is fixed at 20%. However, I am unsure how exactly this will work for foreigners.

Overall my decision to purchase was based on appreciation potential, as well as to secure a foothold in the growing region.

About the Developer

The Overseas Cambodia Investment Corporation (OCIC) is the sole developer of Olympia City and a number of other real estate developments around the country. It is also partnered with developers from other parts of the Asia region on a number of other development projects in Phnom Penh (such as DI-Riviera). OCIC has a track record of completing large development projects in the past.

Additionally, the owner of OCIC is also the owner of Canadia Bank, one of the gigantic banks in Cambodia. There is a vested interest in completing the projects to pump more money into the country.

Risks

There are obviously inherent risks in purchasing real estate in a foreign country where you do not know the local language and have never purchased there before. However, in addition to that, there are a number of other risks in Phnom Penh that should be known before investing.

By 2018, the amount of condo units will increase from 3,090 (2014Q4) to about 10,000. That’s a huge increase of supply in a short several years which could either signal a huge oversupply, or that there is tremendous demand. This could be a huge risk. Additionally, although Phnom Penh has shrugged off the economic slowdown of China, a worldwide economic recession could prove quite painful to a small, growing economy. Another possible risk is getting the money out of Cambodia, which, in theory, should not be hard according to the representatives I talked to at Canadia Bank when I opened my account. However, I have no idea how its laws or banks will be structured in the future, but the country seems to be moving towards opening up, rather than moving the opposite direction. Finally, although there was a lot of political turmoil in the past and things have mostly settled for now (and the economy has seemed to shrug it off), there may well be unforeseen events in the future that could possibly hurt the market.

In the end, although all real estate is local, I do believe in the future of the country of Cambodia and its people. Cambodians are hard working, intelligent, resourceful, and speak many languages. The country is growing tremendously, and is set to grow much more in the coming years, with most of the economic growth in the capital of Phnom Penh. And, as the saying goes, “a rising tide lifts all boats.”

Thanks for this its all very interesting but you didn’t mention how much you paid for the condo?

Hi I would like to share/ask you about the purchase a condo in Phnom Penh.

Do you have line or wechat? Please do add me, my ID is: mickymousepp